bradford tax institute cost

How to claim business. 75 Receipt Rule for Business Vehicles.

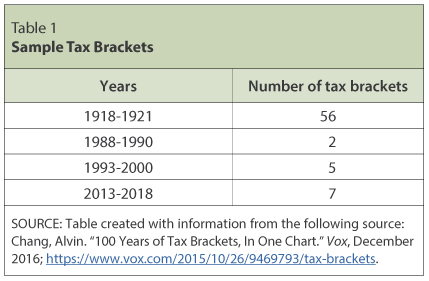

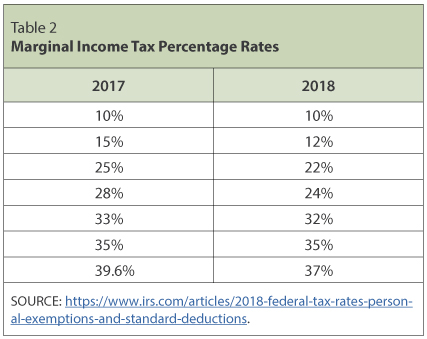

Individual Income Tax The Basics And New Changes

Bradford and Company Inc.

. Saturday 16 April 2022 Edit. Total cost of section 179 property placed in service see instructions 2 3 800000 Threshold cost of section 179 property before reduction in limitation see instructions 3 4 Reduction in limitation. Murray Bradford in 1991.

The use of cost segregation studies must be specifically applied by the taxpayer. National Maryland census-designated place. 1701 Pennsylvania Avenue NW Suite 300 Washington DC 20006 E-Mail.

Each issue is written for you but fully referenced for the most sophisticated tax professional. As youre well aware every time you fill up your car at the pump gas prices are skyrocketing. During the email exchange their customer service individual was extremely rude accuse me of asking her to lie accused myself of lying and was no help to get me connected at all.

Helps agents audit-proof their tax returns and records. Ad Learn What Your Tax Liability Could Be. You understand that the Bradford Tax Institute web site and the Tax Reduction Letter are generalized publications are not rendering legal accounting or other professional advice.

Bradford tax institute cost Saturday March 5 2022 Edit. Tax Accountants Near You Here. Bradford Tax Institute Blog.

Tax Reduction Letter is dedicated to increasing your net worth as a self-employed taxpayer. 2 National brand a brand. I was experiencing difficulties getting logged into the webinar so I emailed for help.

1050 Northgate Drive Suite 351 San Rafael CA 94903 E-Mail. Best of all hosting of a Bradford Tax Seminar wont cost youor your peoplea penny. Subtract line 3 from line 2.

How Rental Property Owners Can Avoid the Net Investment Income Tax If you earn profits from rental property and your income is high enough you pay the 38 percent net investment income tax think surtax on high income unless you can qualify for one of three exemptions as we explain in this article. Allocations must be based on a logical and objective measure of the portion of the equipment that constitutes 1245 property. Ad Stand Up To The IRS.

Bradford Tax Institute Cost - Tax Reduction Letter Tax Smart Solutions For The Self Employed - Not available archived webinars do not offer cpe credits. Your cost is zero Our expert instructor will teach the latest tax reduction strategies at no cost to you. Mamma always strives to get the latest discount codes.

Three ways your agents benefit. 1050 Northgate Drive Suite 351 San Rafael CA 94903 E-Mail. 9 long-playing professionally recorded CDs in a handsome carrying case that turns your car into a tax-savings university so you can learn the most valuable tax-saving strategies for self-employed taxpayers while you drive to.

Bradford Tax Institute Subscription Services 1050 Northgate Dr Ste. 351 San Rafael CA 94903 Telephone. Ill explain what the raise means to you when you read my new article.

Bradford Tax Institute Blog. 1050 Northgate Drive Suite 351 San Rafael CA 94903 E-Mail. Since 1989 Bradford and Company has found billions of dollars in new deductions and.

Bradford Tax Institute Blog. All the latest promo codes and offers can be found at the Bradfordtaxinstitute Com Mamma pages. The fee charged averaged 100 per 12 or a total of 297 for an hour and a half.

Information provided by the Air Conditioning Heating and Refrigeration Institute AHRI and. Well lawmakers also noticed that average gas prices across the country have. Most of the entities comprising the new opportunity are retail 60mil revenues per entity per year large volume AR large YE inventory generally complex chart of accounts etc.

If zero or less enter -0-Dollar limitation for tax year. July 13 2022. Talk with Our Experienced Staff About Your Taxes.

Bradford is the nations pre-eminent tax reduction expert having found an average of 17700 in new tax deductions for over 500000 and counting small businesses and self-employed professionals. Ad Find Reviews Prices Numbers And Addresses For The Top 10 Voted. Nationality a national is a person who is subject to a nation regardless of whether the person has full rights as a citizen.

1701 Pennsylvania Avenue NW Suite 300 Washington DC 20006 E-Mail. Is the market leader and expert in tax reduction seminars and products for the self-employed business owners. Subtract line 4 from line 1.

Presentation length 15 hours. The IRS just raised the standard mileage rates for the second half of the year. An accurate cost segregation study may not be based on non-contemporaneous records reconstructed data or.

The Bradfordtaxinstitute Com offers regular discounts and coupon codes. If zero or less enter -0-. Anyone out there with experience who could shed some light on their fees they charge based on client complexity or other factors.

Tax strategies and techniques depend on your specific facts and circumstances. The Tax Reduction Letter is published by the Bradford Tax Institute which was founded by W. 1701 Pennsylvania Avenue NW Suite 300 Washington DC 20006 E-Mail.

Helps agents reduce their taxes by thousands These strategies are 100 legal and ethical.

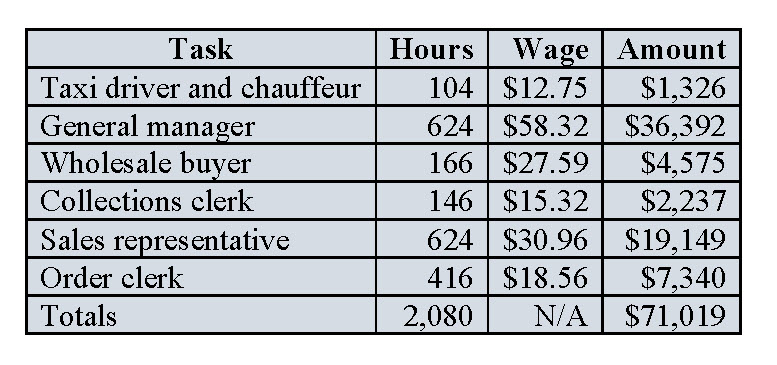

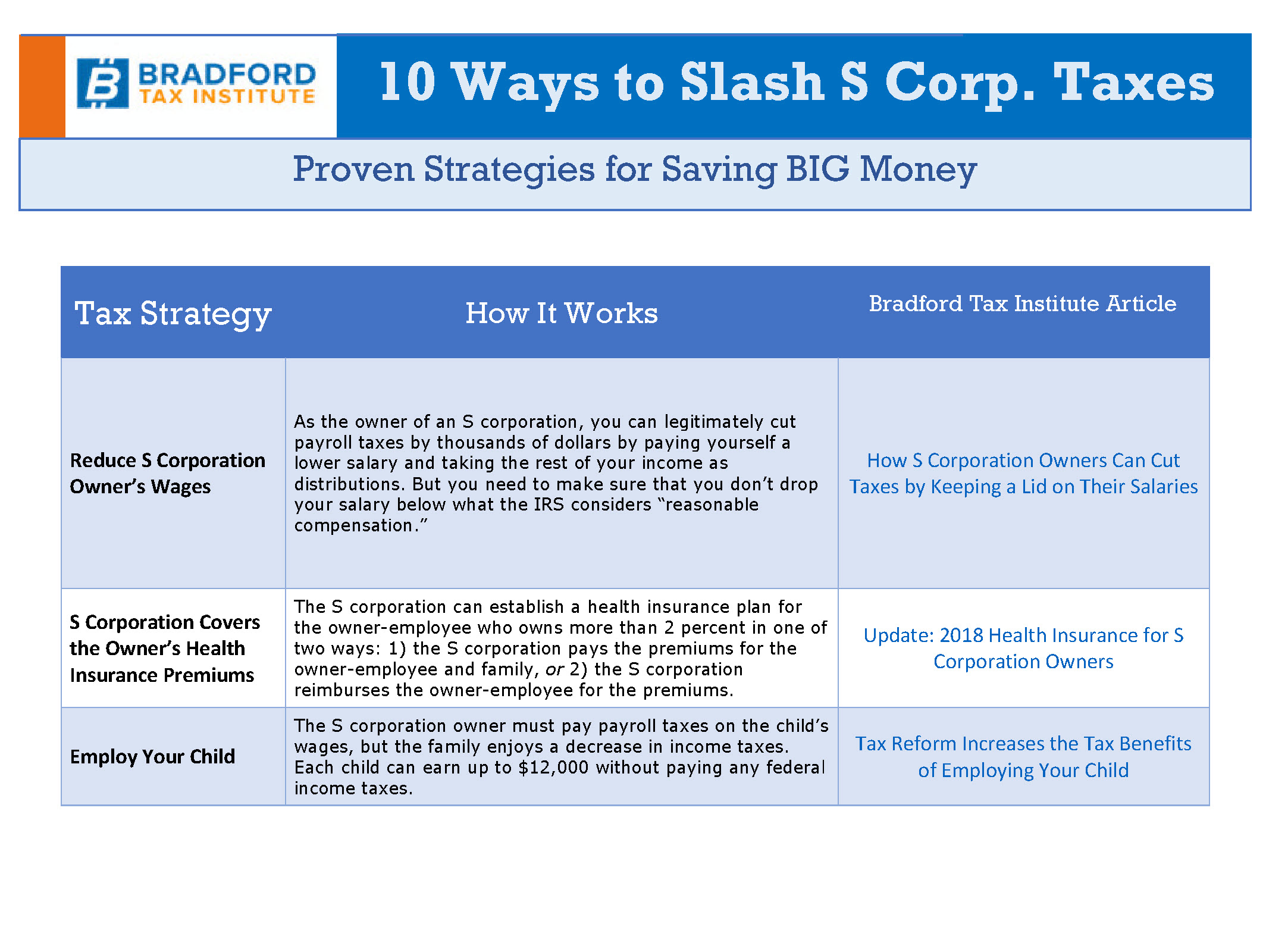

The Practical Guide To S Corporation Taxes

10 Proven Tax Reduction Strategies For The Self Employed

Individual Income Tax The Basics And New Changes

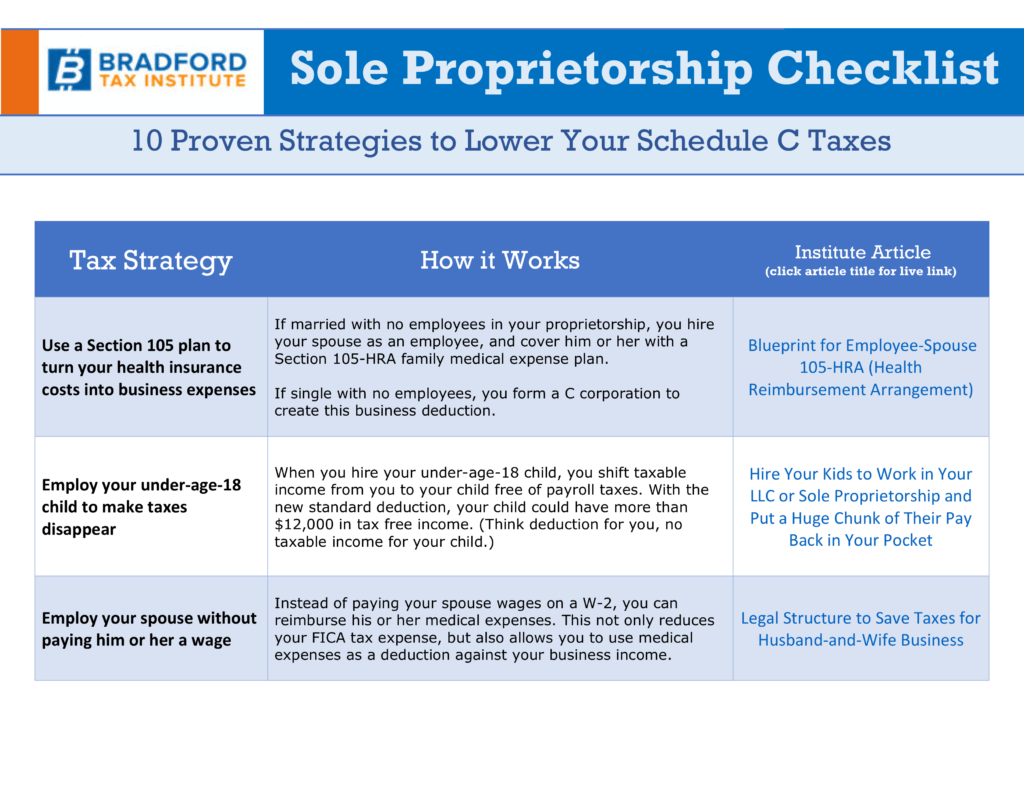

Free Checklist 10 Proven Tax Reduction Strategies For Sole Proprietors

The Practical Guide To S Corporation Taxes

Tax Reduction Letter Tax Smart Solutions For The Self Employed

Income Tax Tips Ronald K Jones Cpa Llc

Free Checklist 10 Proven Tax Reduction Strategies For Sole Proprietors

Tax Course Bradford And Company

The Practical Guide To S Corporation Taxes

The Practical Guide To S Corporation Taxes

The 651 958 00 Email Series Membership And Subscription Growth